On earth of cryptocurrency, the idea of what is bitcoin halving is simple to the network's style and long-term price proposition. These functions, which arise approximately every four years, enjoy a critical role in handling Bitcoin's supply, incentivizing miners, and surrounding industry dynamics. Knowledge the pattern of Bitcoin halvings is essential for investors, developers, and lovers seeking to grasp how that process influences the broader crypto ecosystem.

At its core, a Bitcoin halving is an automatic decrease in the stop incentive that miners get for validating transactions on the blockchain. When Bitcoin was made, miners were granted 50 bitcoins per stop mined. But, every 210,000 blocks—roughly every four years—the prize is reduce in half. This process may carry on until the optimum supply of 21 million bitcoins is achieved, making Bitcoin a deflationary asset by design.

Certainly one of the most important great things about Bitcoin halvings is the managed and predictable issuance of new bitcoins. By halving the benefits occasionally, the rate of which new bitcoins enter flow slows down, mimicking the scarcity of valuable resources like gold. That scarcity assists maintain Bitcoin's value with time, stimulating long-term holding and investment. As a result, Bitcoin halvings subscribe to the cryptocurrency's popularity as “digital gold.”

Halvings likewise have substantial implications for miners, who enjoy a vital position in maintaining the network's safety and integrity. With paid down rewards, miners should become more efficient and aggressive to maintain profitability. This usually pushes invention in mining engineering and encourages the use of green energy sources. Despite lower rewards, the overall safety of the Bitcoin network stays powerful, while the incentive framework adjusts to advertise conditions.

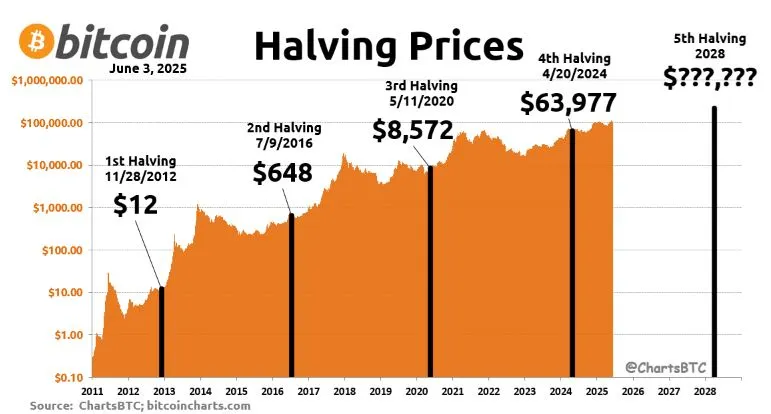

From the industry perception, Bitcoin halvings have a tendency to generate heightened fascination and value volatility. Traditionally, halvings have preceded substantial cost rallies, as decreased source combined with experienced or increasing demand creates upward stress on prices. That cyclical conduct has attracted traders and investors seeking to capitalize on market movements about halving events. Nevertheless, it is essential to see that past efficiency doesn't guarantee future results.

The halving routine also underscores Bitcoin's distinctive economic product in comparison to standard fiat currencies, which may be printed without limits. This estimated present schedule fosters confidence and transparency among users and investors, giving a clear platform for Bitcoin's inflation rate and issuance schedule.

In summary, the routine of Bitcoin halvings is a foundational system that forms the cryptocurrency's supply, miner incentives, and market behavior. By reducing the stop rewards at standard intervals, halvings develop scarcity, promote system protection, and effect price dynamics. Understanding this period is crucial for anyone involved in the crypto space, since it shows how Bitcoin's design helps long-term value and sustainability in a changing digital economic landscape.